Money Matters: Traditional IRA vs. Roth IRA

Editor’s Note: Briant Sikorski from Stratos Wealth Partners in Cary contributed this article.

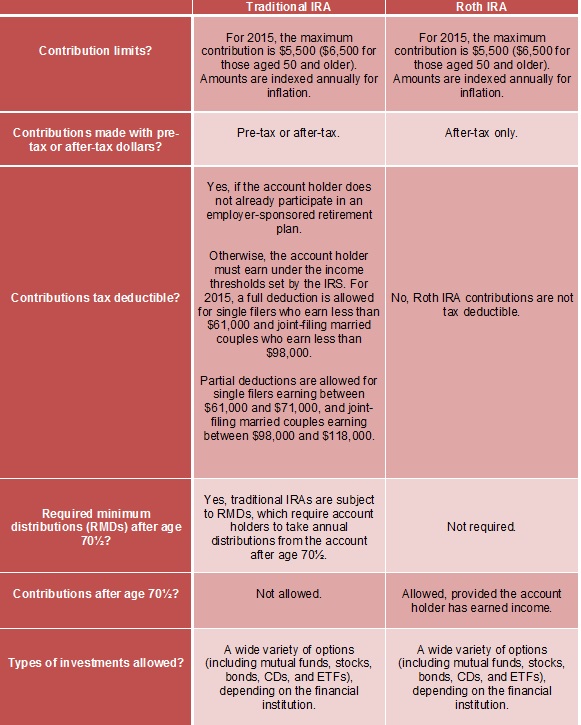

Cary, NC — Traditional IRAs and Roth IRAs – there are some key differences between these two types of individual retirement accounts (IRAs). While the contribution limits are the same for both, each has its own specific rules and potential benefits.

Traditional IRA vs. Roth IRA

It’s important to review both types of vehicles and plan your IRA strategy carefully.

No matter which type you choose, make the most of your IRA by contributing to it regularly.

*Distributions made prior to age 59½ may be subject to a 10% additional federal tax.

Related Content

Read more CaryCitizen articles about financial planning and money matters.

Briant Sikorski is a Wealth Advisor at Stratos Wealth Partners. Photo by 401(K) 2012.