Money Matters: Financial Planning for Unmarried Domestic Partners

Editor’s Note: Briant Sikorski from Stratos Wealth Partners in Cary contributed this article.

Cary, NC – How times have changed. Only 26 percent of American households are composed of married couples with dependent children, according to the latest U.S. Census. Financial advisors may wish to educate themselves regarding the unique financial needs of unmarried couples – a group that may already represent a growing number of your clients.

The number of American households of married couples with dependent children has dropped significantly: In 1970, 40 percent of households fit in that category. Meanwhile, over the past 40 years, the number of unmarried couple households has increased by a factor of four, to over 6 percent of the population; there are currently about 7.5 million such households in the United States.

Legal Protections

Unlike married couples, unmarried partners lack many of the legal protections or rights granted to spouses in the event of divorce or death. Although most states will consider a claim by an unmarried partner, there is no specific legal precedent in the absence of a written contract. Therefore, such couples may wish to consider creating a domestic partnership agreement. This document can detail the sharing of expenses as well as the ownership and distribution of assets should the relationship end. A domestic partnership agreement is especially important in situations where one partner is the primary breadwinner or owns the majority of assets.

Decision-making control is another crucial issue. Encourage clients to create durable power of attorney and health care proxy documents. Some states also require a living will to address life-support issues. Creating a letter of instruction regarding burial or memorial preferences should also be considered. If such documents do not exist, an unmarried individual may find that his or her partner’s blood relatives will be allowed to make these key decisions if the need arises.

Unmarried couples with children face another concern: legal guardianship. Nearly 40 percent of unmarried couples have children under the age of 18. Yet legal guardianship of these children may not be as sound as for married couples. Because of this, unmarried couples should consider signing a written agreement acknowledging parental rights and responsibilities and having each partner name the other as primary guardian in wills.

Achieving a Comfortable Retirement

Although both married and unmarried couples need to save for retirement, unmarried couples may need to save more. Why? Because they will not be eligible for each other’s Social Security benefits and, in some cases, employer-sponsored retirement plan distributions. Make sure your clients check their plan rules and specify plan beneficiaries. The IRS now allows a non-spousal beneficiary of an IRA to take required distributions over his or her lifetime rather than in a lump sum, allowing for potential tax-deferred growth over a longer period of time. Therefore, clients may wish to contribute the annual maximum to an IRA ($5,500 in 2015) before maximizing contributions to an employer-sponsored retirement account.

Annuities may also be an attractive investment vehicle – especially for wealthier clients – since they allow for unlimited after-tax contributions, regardless of income or sources of income. Additionally, the payout methods of annuities usually include insurance features, enabling a named beneficiary or beneficiaries to receive payments if the owner dies before withdrawals begin.

While discussing retirement issues, remind your clients to review all financial documents, including employer-sponsored retirement accounts, IRAs, annuities and life insurance policies to ensure named beneficiaries are consistent with those mentioned in wills.

Estate Planning Issues

For a spouse, a marriage certificate is the gateway to a number of financial benefits that unmarried partners do not necessarily possess. This disadvantage is especially apparent in regard to estate planning.

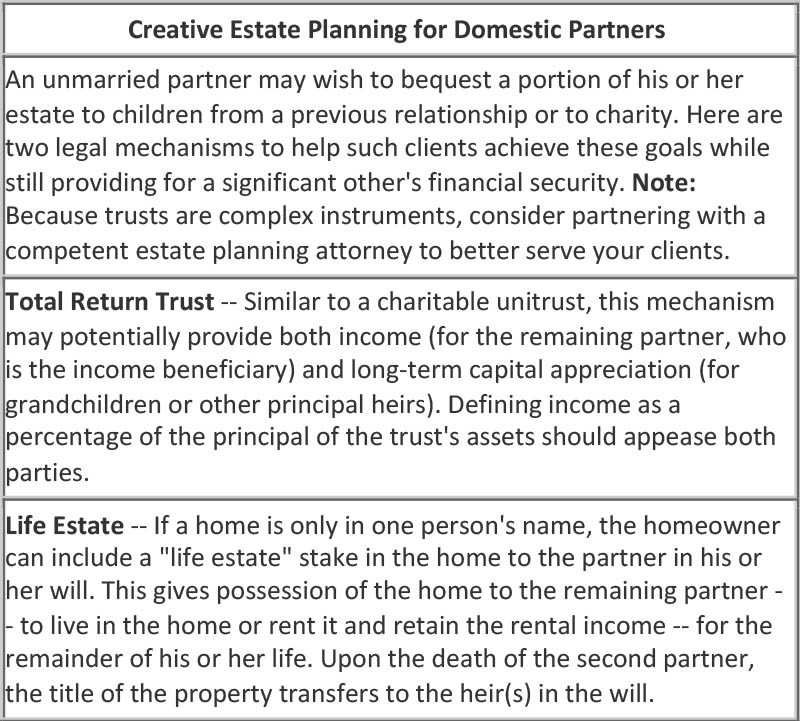

It’s essential for domestic partners to create wills. Impress upon such clients that if they die without a will, the state may distribute their partner’s assets to his or her closest blood relatives. To help rebut a challenge to a will, suggest that clients videotape their wishes in the presence of an attorney. Additionally, a living trust may be desired because it remains confidential and is not subject to probate.

Transferring assets upon death requires careful planning for unmarried partners. For example, federal tax law allows all assets to pass to a spouse tax free and no applicable estate taxes are due until the second spouse dies. Unmarried couples do not enjoy this tax advantage.

If a client has significant taxable assets, it will be necessary to pursue other avenues to avoid estate tax. Currently, the federal estate tax is 40 percent on estates over $5.43 million. To help reduce tax liabilities for the surviving partner, clients can purchase life insurance to pay any potential federal and state estate taxes. A surviving partner must own the insurance to avoid it becoming part of the estate of the deceased. Therefore, each partner must own enough insurance to pay any anticipated taxes on the assets of his or her partner.

Society is changing, but laws are lagging. Financial professionals who want to protect clients’ assets and potentially grow their business should take into account the complex financial needs of domestic partners.

Points to Remember

- Unmarried couples may wish to create a domestic-partnership agreement, which should detail the sharing of expenses as well as the ownership and distribution of assets should the relationship end.

- Legal protections, such as durable power of attorney and health care proxy documents, and in some cases, a living will, can help safeguard decision making control if one partner is unable to make financial or health care decisions.

- Domestic partners may need to save more for retirement than married couples. Annuities and IRAs may be attractive retirement savings vehicles for such couples.

- Careful estate planning, including the use of trusts, may be appropriate for effective wealth transfer as unmarried partners will not enjoy tax advantages that federal law bestows upon spouses.

Disclaimer

Annuities are long-term investment vehicles designed for retirement purposes. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Guarantees are based on the claims paying ability of the issuing company. Withdrawals made prior to age 59 are subject to a 10 percent IRS penalty tax and surrender charges may apply. This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

Briant Sikorski is a Wealth Advisor at Stratos Wealth Partners. Photos by J. Dickert and Clyde Robinson.