Money Matters: Boost Your Borrowing Power by Boosting Your Credit Score

Editor’s Note: Briant Sikorski from Stratos Wealth Partners in Cary contributed this article.

Cary, NC – Your credit score is a rating that lenders can use to gauge how likely you may be to repay debts on time. A typical credit score will range between 300 points and 850 points. Generally speaking, higher scores are presumed to represent lower risks – the more attractive your score might be to a lender, the better the deals you may be offered. In other words, you can improve your position in the borrowing process by taking steps to boost your score.

Photo courtesy of CafeCredit.com

Factors That Determine Your Credit Score

Credit scores are compiled by the three major credit reporting agencies – Equifax, Experian and TransUnion – based on information provided by creditors.

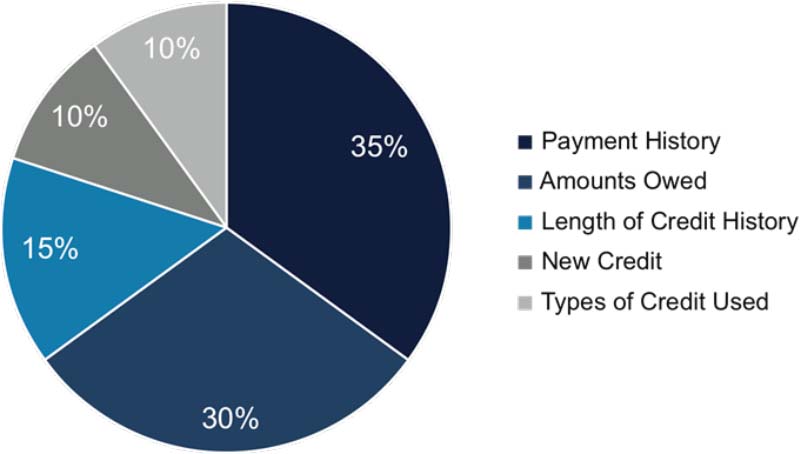

They generate scores using a proprietary formula that assigns weightings to the five main factors illustrated below:

- Your payment history, which is whether you have missed or been late with any credit payments (the fewer late or missed payments, the better)

- Your utilization ratio, which is the amount you owe creditors compared with the amount of credit that is available to you (the lower the utilization, the better)

- The length of your credit history (how long various accounts have been open)

- The types of credit you use (the more diversified your credit resume is – among car loans, mortgages, credit cards, etc. – the better)

- The amount of new credit on your record

As you can see in this chart, the most important factors in your score are generally the amounts you owe and the rate at which you repay your loans.

Relative Weight in the Credit Score Equation

Briant Sikorski is a Wealth Advisor at Stratos Wealth Partners. Photos courtesy of Briant Sikorski and CafeCredit.com.